What We Have Covered in This Article

Last Updated on July 12, 2022 by Editor Futurescope

There are a number of reasons you may want to calculate crypto profits from your trades. It’s a way to check in on your portfolio. It can help you spot holdings to increase or sell-off.

And it can help generate useful information for weighing new investment ideas. You may also want to know how to calculate crypto profits for tax reporting purposes.

The following short, how-to guide is a complete answer to the question for all these purposes.

You may want to use a free web browser-based crypto profit calculator to help make the math computations easy, fast, and accurate. In the course of the guide, a free, no registration, user-friendly crypto profit/loss calculator will be recommended.

How to Calculate Crypto Profits in USD or Your Local Currency

To calculate crypto profits, begin with the principal investment. That is the USD amount, or your local currency amount, of a transaction to purchase crypto. Then subtract it from the amount you sold it for today, or that it would sell for today if you were to sell it at today’s price.

The result is the profit or loss from your trades. If you do sell at that exit point, it’s called a realized gain or loss. If you hold your principal and earnings or losses, it’s called an unrealized gain or loss. Realized profits and losses are final for those trades. Unrealized profits or losses could flip and become losses and profits depending on changes in the market price.

Now to get the percentage increase or decrease on your principal, take the gain or loss and divide it against the principal. So if your investment of $100 sold for $115 for a gain of $15, divide 15 by 100 to get .15 or 15% ROI (return on investment).

Crypto Calculator Profit: What If Scenarios

You can also think ahead and see how your initial investment would grow or shrink based on different price projections for a coin you hold. So using the previous example, if you buy $100 the day the price is $100 per coin, you could project a 15% ROI over a period.

Then multiply 1.15 by different principal amounts to see that $100 invested would net $15 and $200 invested would net $30. You can also back-test strategies this way. For instance, you could notice crypto delivers an attractive minimum ROI over a period after every blockchain halving event, technical market signal, or over any contingency for a long enough period.

Then you can calculate crypto profit projections based on entries into long positions in the current crypto market if historical trends, patterns, and tendencies repeat under current conditions. This is a smart way to strategize crypto trading and entry points for long-term holding.

Use A Crypto Profit / Loss Calculator

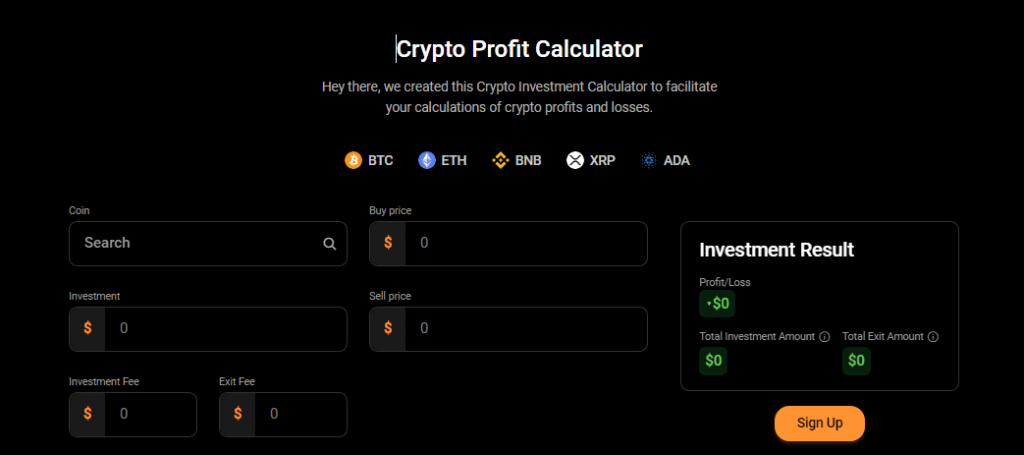

You can easily calculate profits and losses right in your browser using a free crypto profit calculator. I recommend CoinStats wallet a free crypto calculator.

To uses the calculator, you simply search for the cryptocurrency in the coin search bar. After selecting your coin, the site will auto-populate the buy and sell price fields.

It uses the current crypto exchange market price. That saves you time going to look it up somewhere like CMC or TradingView and then have to type it into a spreadsheet or search engine yourself. Then type in the principal amount into the investment field.

After that, you can adjust the buy and sell price fields to calculate your gain or loss on a crypto trade. Simply adjust the buy price to what you bought it for and today’s sell price is already plugged in. Or adjust the selling price to projected amounts to help yourself evaluate a trade’s future prospects.

What’s really nice about CoinStats’ crypto profit calculator is that it also includes fields for investment fees and exit fees. You don’t even have to tap the calculate button. It auto-updates the output results as you update the fields. The results fields are Profit/Loss, Total Investment Amount, and Total Exit Amount. Fees are included in the calculations.

Read to the bottom of the crypto profit calculator page to learn about how CoinStats can track the profits and losses for all your wallets and multiple portfolios all in one app. That saves you the time of using a calculator and figuring it all up yourself. It just automatically tells you where you’re at with an up-to-date report and overview of all your crypto holdings.

How to Calculate Crypto Profits for Tax

Be sure to carefully read and follow all the pertinent tax rules and guidance from your region’s tax-collecting agency. Currently, in the United States, cryptocurrencies are regarded as property by the Internal Revenue Service. The IRS requires reporting on capital gains and losses from sales of cryptocurrency as it does for any other property bought and sold at a profit or loss.

The most recent IRS guidance on 1031 exchange exemptions for crypto is that they do not qualify for the exemption. So for example, if you buy BTC, sell for a profit, then immediately use the profits to buy ETH, you are still responsible for any tax obligation on the BTC sale. It is not exempt as a like-kind exchange under Section 1031.

The IRS allows you to pick your accounting method to maximize your tax savings: FIFO (first-in-first-out), LIFO (last-in-first-out), and HIFO (highest-in-first-out). You can also change your accounting method for crypto profits and losses each year.